A Curated List of the Technology Transactions Happening Across Canada

Garibaldi Capital Advisors is a technology-focused transaction advisory firm founded by Brent Holliday, Paul Kedrosky and Andrew Jones. We have committed to help Techvibes curate the technology transactions happening every month across Canada.

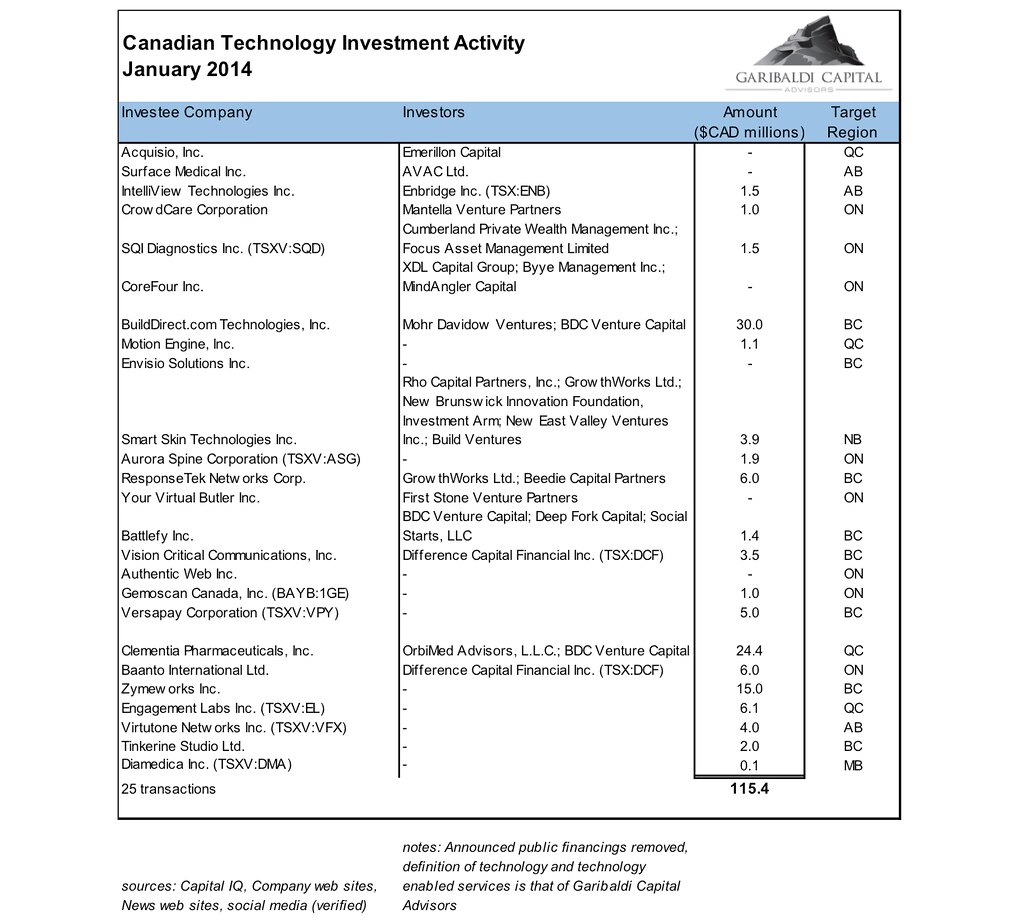

Starting with the January 2014 cohort (below), we will aggregate and share our summary regularly. What we need from you, participants in the technology ecosystem, is further information to fill in the blanks where our data sources fall short: missed deals, angel or seed financings and any other corrections or clarifications are encouraged. While Garibaldi starts the ball rolling, we intend to make all the data that is gathered here available publicly through Techvibes.

This is a collective effort at accuracy we feel can’t be matched by any other method. We will do our best to verify submitted information (and where it is verified, send corrections to our data sources). Garibaldi will then take the data and add to it (categorization by industry, stage of the company, etc.) and present quarterly and annual totals for everyone to share.

Next month, and in the months that follow, we will add accompanying commentary. As you can see below, the reported total of $115 million invested in private companies and private placements into public companies (also known as PIPEs) includes a couple notable transactions. BuildDirect Technologies of Vancouver closed its $30 million capital raise (a Garibaldi assisted transaction) in January from Mohr Davidow, BDC and two other Canadian institutions. Clementia Pharma in Quebec closed $24.4 million from OrbiMed and BDC. BC was very active in January as Zymeworks’ $15 million helped make BC’s reported total exactly half of the $115 million raised across Canada. Of course, this is subject to change as we crowdsource further data.

On the M&A front, a pair of telecom related deals lead the list with Eastlink continuing its buy up of small cablecos across Canada with its acquisition of Bruce Telecom for $26.5 million and the Teliphone Company divesting its control stake in Navigata Westel for $45 million.

As you can see, many of the M&A transactions do not have reported amounts and many never will, although there will be rumours and talk around the bar. We only report amounts where there is a public disclosure of some form.

Please feel free to comment below or email us at ea@garibaldicapital.com.