Venture Capital Industry Optimistic About Canada in 2015

Venture capital and private equity activity posted strong results in 2014.

Venture capital and private equity activity posted strong results in 2014.

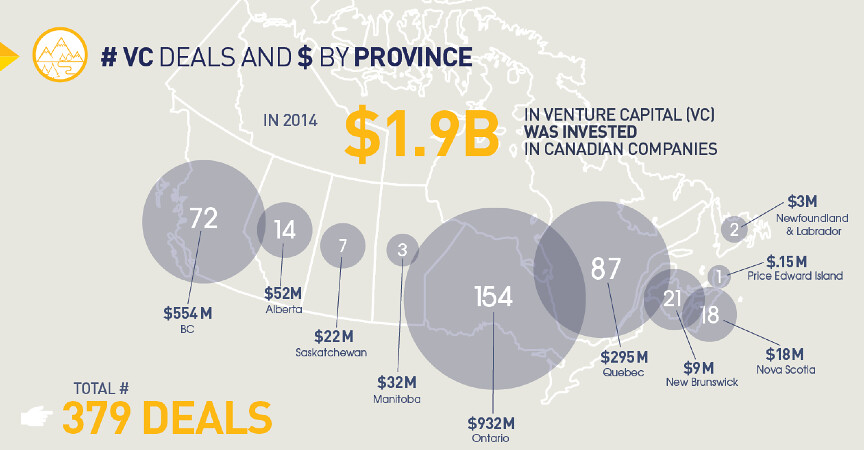

According to the Canadian Venture Capital & Private Equity Association’s (CVCA) 2014 VC and PE Market Activity report, there was a total of 379 venture capital deals with $1.9 billion invested, and 296 private equity deals with $41.2 billion invested last year.

“Venture capital and private equity investment remains robust and the feeling amongst our industry is that won’t change in 2015,” said Mike Woollatt, CEO of CVCA. “Despite the economic uncertainty in Canada, there are opportunities.”

The strong results are expected to continue in 2015. Data collected from a comprehensive survey of CVCA members shows that the vast majority (77 per cent) believe current economic conditions favour the private capital industry. Notably, almost two-thirds (61 per cent) of private equity members believe that depressed oil prices improve their business outlook for this year.

Venture capital disclosed amounts totaled $1.9 billion invested in 2014. ICT continues to drive the majority of venture capital investment (63 per cent of completed deals). Top three sectors: ICT accounted for $1.3 billion invested, life sciences accounted for $423 million invested, and clean technology accounted for $133 million invested. Top three regions: Ontario had 154 deals and $932 million invested, Quebec had 87 deals and $295 million invested, and British Columbia had 72 deals and $554 million invested.